|

||||||||

|

||||||||

|

||||||||

|

|

||||||||

|

| [discount_rates_problem] [long_term] [riskpremia_historic] |

|

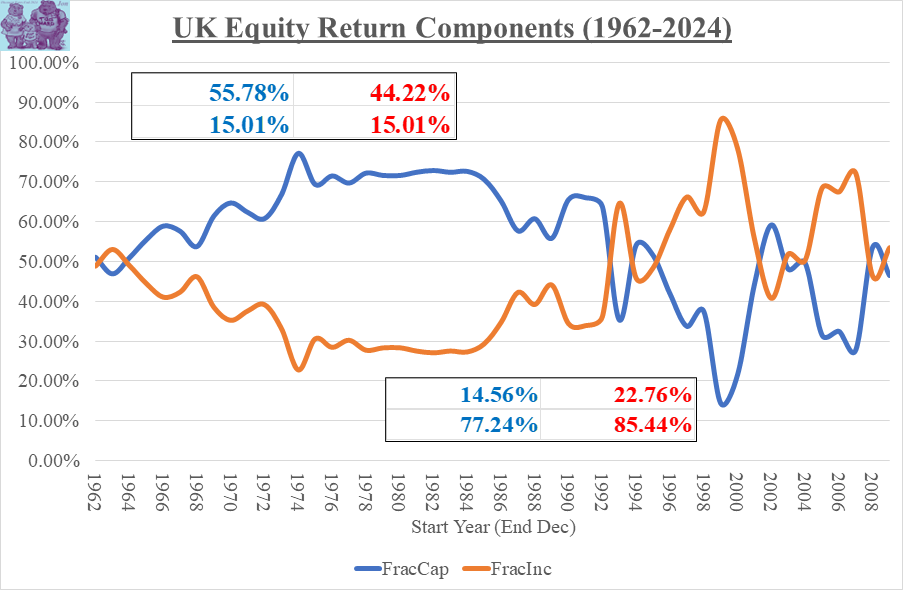

It has been common to assess equity risk premia (the return difference between returns on equities and bonds), allowing for all of the capital growth observed in the past. In fact, the main volatility in equity returns stems from capital growth rather than from dividends. The chart below looks at what the risk premia over periods of 15 years would have been if the capital return component had been 50% (“Premium_050%”) OR 75% OR 100% of what had been observed. The upper block shows the mean and standard deviation while the lower block shows the minima and maxima. On average, between 1962 and 2024, the capital component of the total equity return over 1 year was 61% (the same as the previous year). For periods of 15 years starting from 1962, the equity return capital component (chart here) averaged 56% of the total return (standard deviation 15%), virtually unchanged from the previous year. Interestingly, 50% was assumed throughout the 1980s by at least one major consultancy. If capital had accounted for 55% OR 70% OR 86% of the total equity return, then the average equity risk premium over periods of 15 years would have been zero OR 1% pa OR 2% pa.

|

|||

|

|||